April 12, 2024

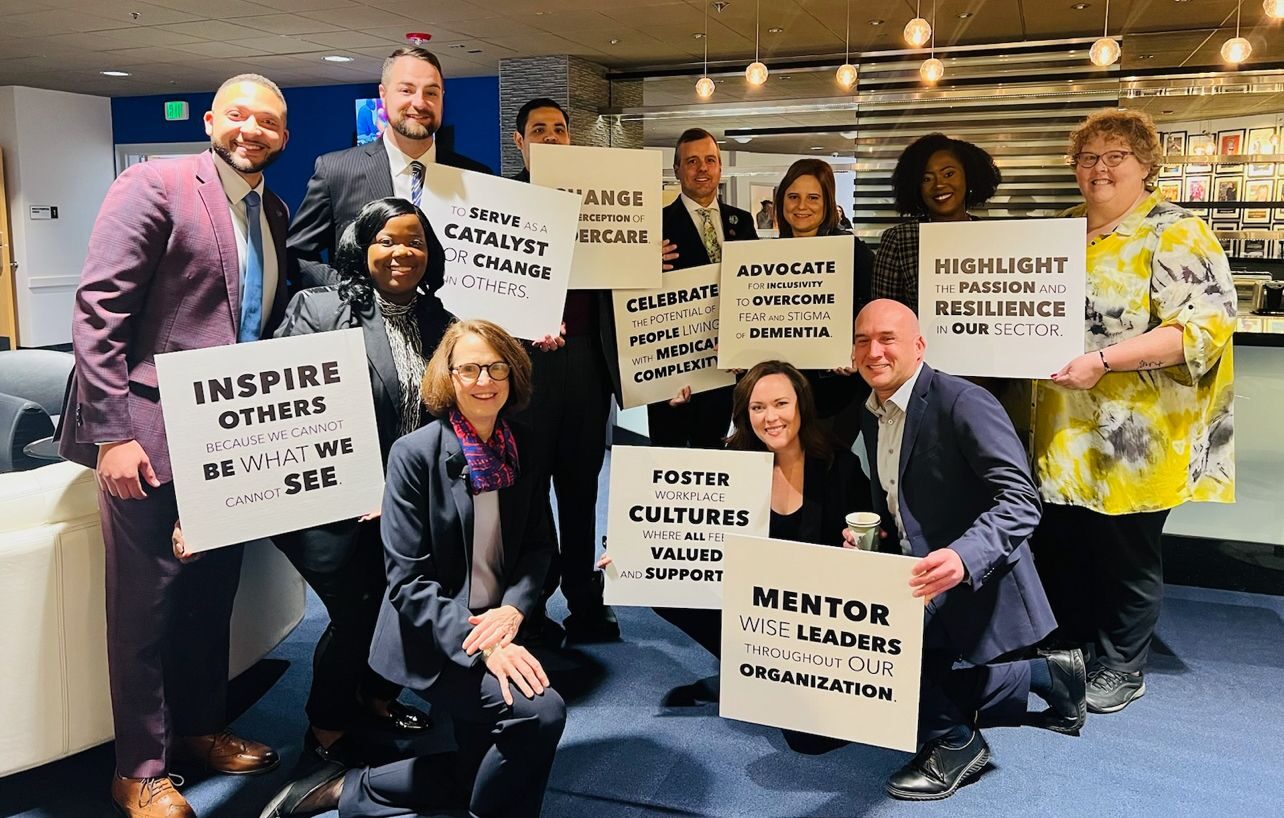

National Advocacy: April 16 Senate Hearing to Focus on LTC Workforce Shortages, Improvements

Senate Special Committee on Aging hearing witnesses include RN and specialist caregivers, academics, educators; video, downloads to be available.

LEARN MORE