April 17, 2024

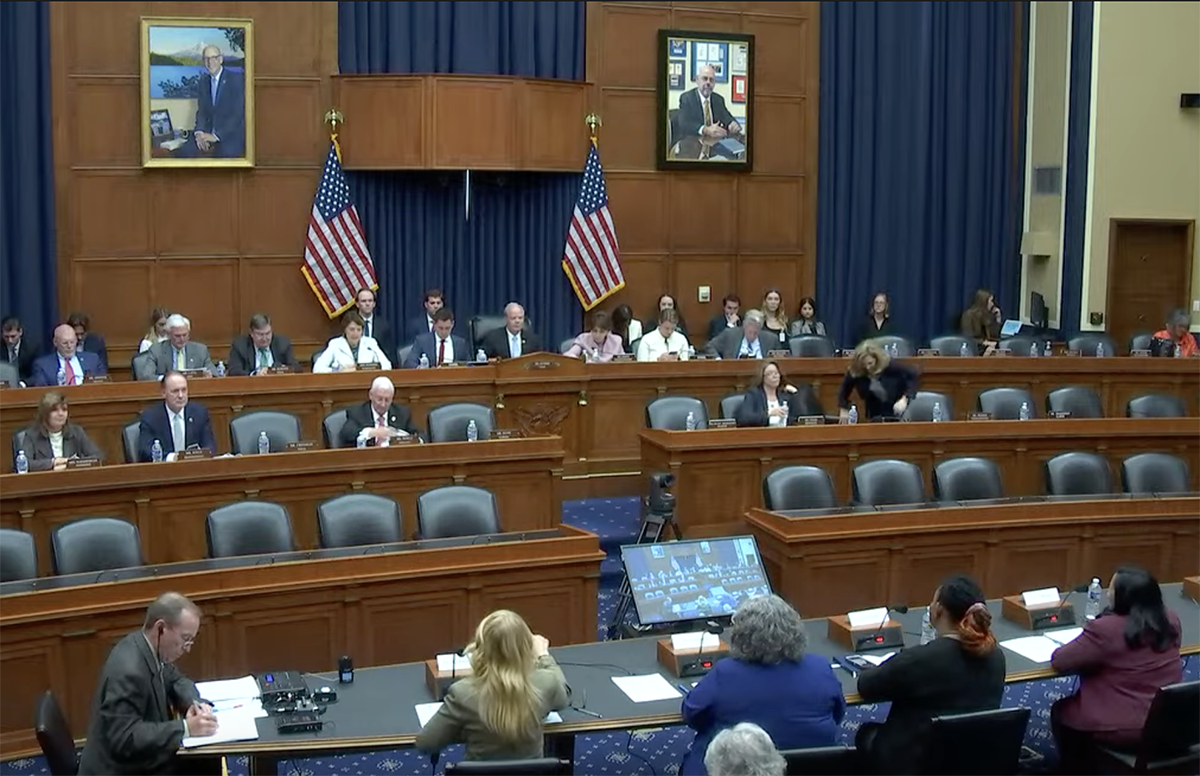

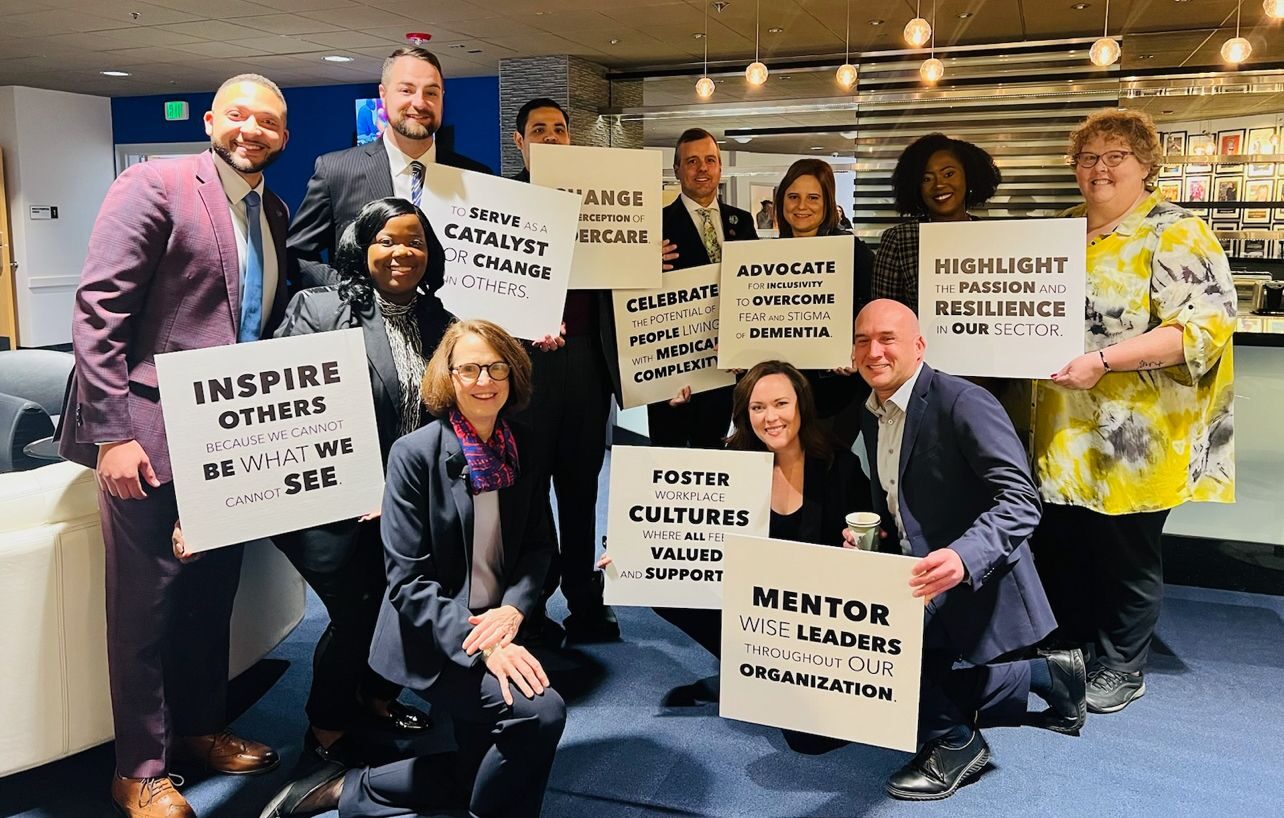

National Advocacy: LeadingAge Members ‘Speak Up and Speak Out’ on Lobby Day 2024

More than 240 members met with lawmakers and staff about critical issues including staffing mandates, housing and hospice expansion, Medicare Advantage, and more.

LEARN MORE